Quality of life improvements for Reward creation.

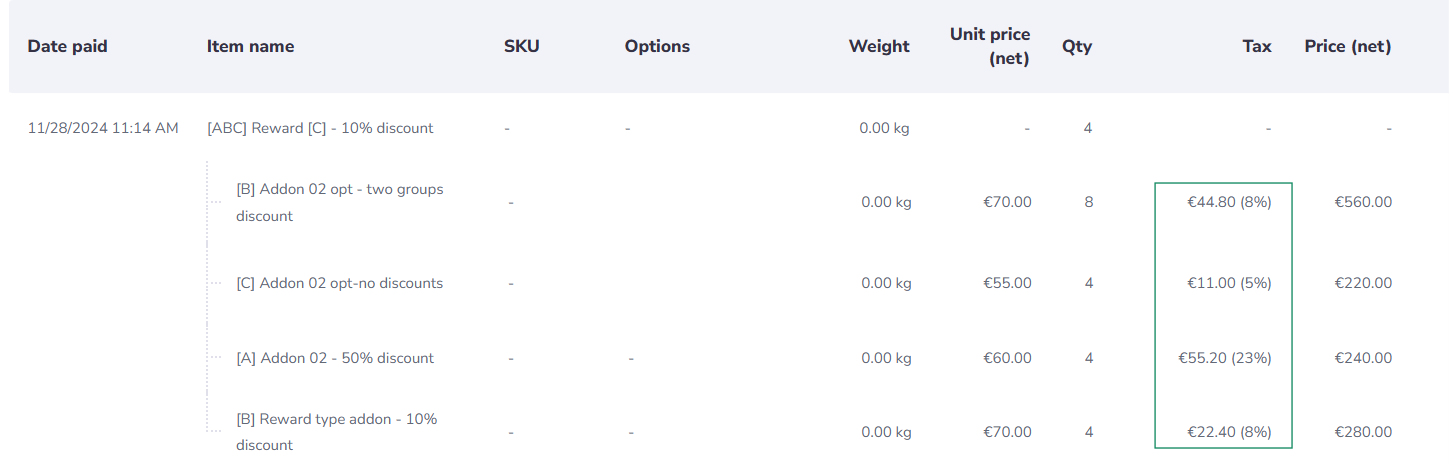

Different tax rates for set pieces

In Europe, VAT may vary from product to product, meaning backers will pay lower VAT for books than for items such as dice. Previously, you had to determine the tax rate for the entire bundle, but from now on, the tax rate will not be tied to Rewards, but to the individual items in the set. This means you can bundle items with different tax rates without having to give much thought to tax calculations. Creators from outside the European Union don't have to worry about collecting EU VAT, as Gamefound handles it for them (in the same way as for non-UK creators Gamefound handles UK VAT).

The feature should prove very useful not only for TTRPG creators, but everybody wanting to include, for example, art books in the All-in tier.

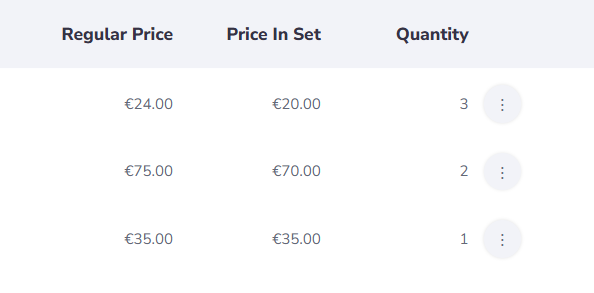

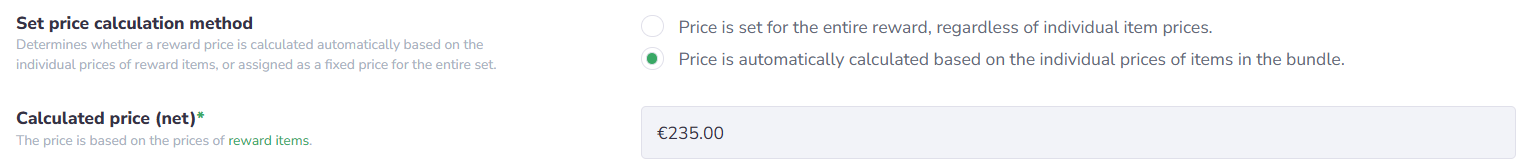

Reward value calculation based on piece prices

Access to this feature is (for now) given on demand, so if it's something that you are excited about contact your account manager to enable it for you.

When enabled, you can choose how the price of the Reward should be determined, and either set it manually or calculate the value based on set pieces by setting mandatory "Price in set" value. This in tandem with previous feature will help you manage mixed tax pledges easily and accurately.

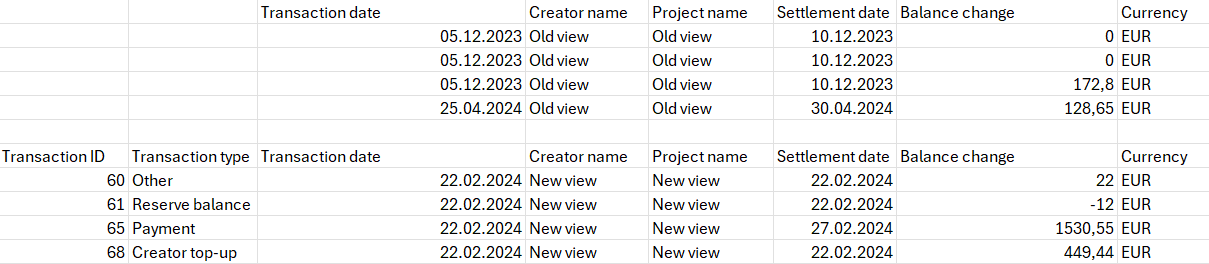

Transaction Export improvements

We also added two new columns to help with clarity of Finance -> Transactions export. Now you can see the ID of the transaction making it easier to tell them apart, and also the transaction type. Currently we support 7 types: 'Payment', 'Refund', 'Tax settlement', 'Payout', 'Creator top-up', 'Payment cancelation', 'Reserve balance', and if the payment is not among these, it's marked as 'Other'.

As always feedback is appreciated, and don't forget to check out the app!

Google Play: https://gamefound.com/s/android

Apple Store: https://gamefound.com/s/ios

Until next time

Alex Radcliffe

CMO of Gamefound